HomeAbout You

About You

About You

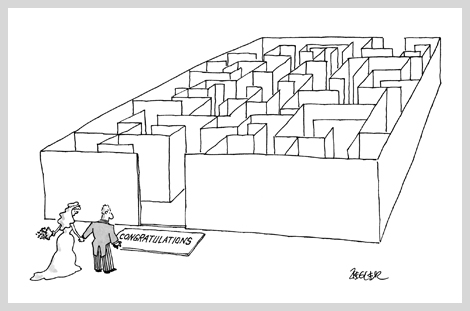

While research has focused on how genes and brain activity influence decisions about risk and reward, there is no simple way to predict your investment behavior. It has been shown that most people can decide what to do investment wise by asking themselves questions and realizing what answers are suitable for their specific circumstances.

DeCamilla Capital can work with you to assist your investment decision making and money management. We encourage you to assess your investment portfolio as it relates to where you are in life and what type of investor you are. We are distinctly different from other money managers and prefer for you to determine if we are a good match for your investment needs.

Only you can ultimately decide what you want your own money to accomplish—you’re in the driver’s seat.

Investment Portfolio Assessment My Current Investment Process

Your individual investment process and focus varies from that of your neighbors, colleagues, and friends. The process should be one of continuous reflection and refinement. To help you characterize and determine where you are at in your investment process, think about the following.

My personal investment decision-making process is best described as:

- Reactive: “I respond to ideas when my broker calls or I see one who I think has a good idea and call him.”

- Passive: “I let a third-party handle it. I get the statements but don’t spend much time on it, if at all. It’s all “Greek”to me.”

- Madness: “I listen to a guy on one of the cable TV business programs. His ideas for his own family trust are good enough for me.”

- Strategic: “I know what I need to do but I’m uncertain whether my decision will get me where I need to go.”

- Aggressive: “I’m looking to make money so my capital needs to stay in motion. I constantly review my investment positions and make trades based on my own research and instincts. I’m not reluctant to use leverage to enhance my returns or to concentrate on one large position. Option trading doesn’t scare me.”

Investment Portfolio Assessment

Where Are You Now?

I am:

| • Just starting out in my career: | (30 to 40 years of age) |

| • In my peak earning years: | (40 to 55 years of age) |

| • Pre-retirement timeframe: | (55 to 65 years of age) |

| • Retirement: | (65 plus years of age) |

| • Other: | Pension trustee, Conservator |

Investment Portfolio Assessment

Questions To Ask Yourself

In the investment and financial world the right questions often provide clear answers. Personal and specific perspective, knowledge, and attitude towards investing one’s money vary from person to person. Gain insight into your own investment situation by pondering the following questions. The exercise may help you when considering DeCamilla Capital as your money manager.

- Am I currently relying on my investment portfolio for current income and/or capital appreciation?

- Do I, or will I have an employer-sponsored pension? If so, does it have a cost-of-living escalator provision?

- Do I expect regular increases in my medical insurance premiums? At what rate?

- How long do I plan to be employed?

- Do I take federal and/or state tax deductions for my investment-related expenses? Can I easily determine my investment account costs and fees?

- Am I surprised annually by the tax reporting and tax liability for my portfolio? Do I have any flexibility and influence as to when capital gains are booked?

- Do I know the annual dividend yield of my portfolio? Do I know its rate of dividend increases? Do I know the total annual dividend income?

- Do I know what my Required Minimum Distribution (RMD) is for my Investment Retirement Account (IRA)?

- Do I understand the difference between a portfolio current yield and its total return?

- Do I have capital tied up in non-performing or illiquid investments? (e.g., private partnerships, non-traded REITs, annuities, hedge funds )

- Do I have a personal investment philosophy? Do I see a glass as “half empty” or “half full”?

- Is my current capital enough to retire on? (i.e., at a reasonable rate of return and withdrawal will my capital base support my lifestyle?)

- Am I considering retirement but not sure how to best achieve regular income from my investment

- Would an adverse outcome in any one of my investments affect my lifestyle?

- Am I receiving adequate and sustainable cash flow from my investments?

- Do I receive multiple account statements from multiple investment management sources? Do I understand them?

- Can I readily obtain the annual rate of return on my portfolio from my investment management firm? Can I easily access my portfolio account balance sheet and income statement?

- Is my money manager someone I can call directly when I have questions or concerns? Is he/she bound by a fiduciary standard?

- Do I have an adequate understanding of the capital markets and where my investment advisor is in the “financial food chain”? Is he/she bound by law to act in my best interests?

- For pension trustees, conservators, and fiduciaries in charge of not only their own money, but other individuals’ money as well. Do I have a trained and experienced professional I can rely on for unbiased (unconflictive) advice and responsible investment leadership?

- Do I have a written Investment Policy Statement?

How DeCamilla Capital Is Different

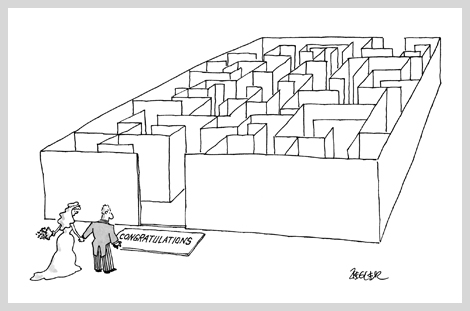

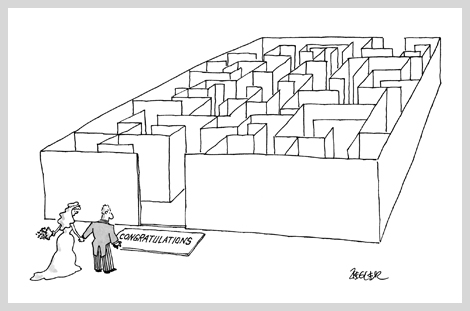

Does DeCamilla Capital Fit You?

DeCamillaCapital.com represents a “No Sales Zone.” We want everyone visiting our website to understand we have no products to sell, offer no free dinners, and do not host Social Security seminars. Contact us if you need straightforward investment assistance or have money management questions. Like all companies we want new business but we are not seeking to make it seem like investing is easy.

In our view, investing client capital is a risky undertaking that requires diligence and care. Unfortunately, many people in the financial services industry think otherwise. To them your capital is grist to generate commissions or asset management fees. These are the same firms and business men and women who nearly drove the U. S. economy to the brink of collapse by selling their toxic mortgage securities to pension funds, endowments, and individuals.

Of course there are an abundance of financial entities and sales people ready, willing, and more than able to persuade you there is an investment version of Santa Claus. Please do not confuse DeCamilla Capital with those financial services firms.

Advertisements featuring talking babies, toddlers asking their Dads about financial matters, or dramatic actors pitching online investment opportunities are non sequiturs in our view.

DeCamilla Capital should not be confused with the average broker, financial planner, or wealth advisor. We are fiduciaries who take responsibility for investment and manage investment portfolios for those individuals who cannot or do not want to do it themselves.

We have nothing to sell but a great deal to offer.