HomeOur Process & Approach

Our Process & Approach

Our Process & Approach

Approach to Asset Allocation

Historical financial market data shows U. S. stocks have traditionally been the best performing asset class over most 10-year periods in the past century. DeCamilla Capital’s approach to asset allocation recognizes such a successful long-term track record and that U. S. stocks should, and do, warrant the weight of a portfolio’s asset allocation.

Market Listed Equities

We prefer to remain 100 percent invested in market listed equities—and like-minded clients hire us with this attitude in mind. While the U. S. stock market is far from perfect, DeCamilla Capital knows the facts and odds favor owning the best long-term performing asset class, domestic equities. No one can divine the perfect time to be in or out of the market so we are firm advocates of a proactive fully invested approach to asset allocation. Riding out a bear market is not nearly as painful as missing the upside of good markets.

A fully-invested approach may be weakened or enhanced due to specific client factors and circumstances. Other than emergency or special purpose savings DeCamilla Capital views cash as a temporary holding and we encourage our clients to reflect this perspective. This is not to say we can’t, or won’t raise cash during periods of over valuation or economic stress. Cash is simply not a permanent component of the DeCamilla Capital allocation—it is a temporary condition and staging area prior to our making longer term commitments. Because of our long-term focus clients should not expect us to meet their temporary or unforeseen liquidity events without us having to sell assets at what could be inopportune times.

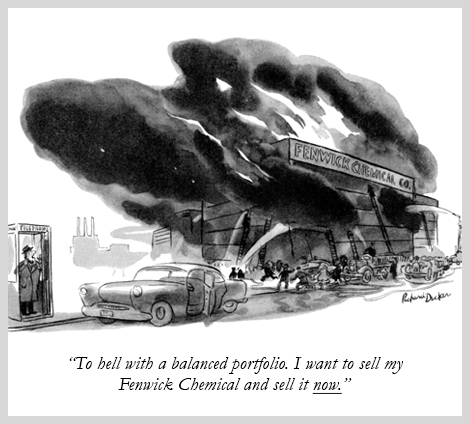

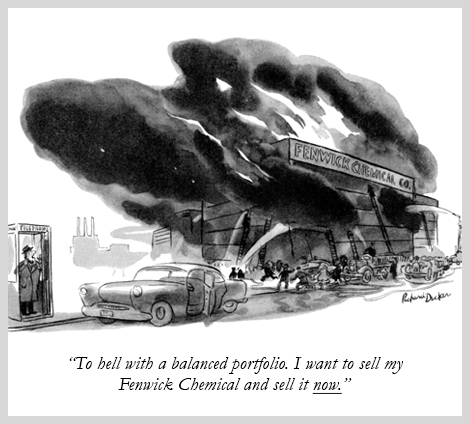

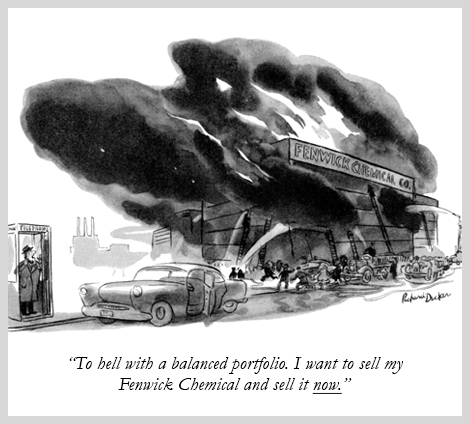

Myth of Asset Allocation

The belief one can somehow avoid market volatility by spreading capital over a wide and usually obscure array of assets is the myth of asset allocation. Often what passes for “asset allocation” and “rebalancing” are a fool’s errand and an excuse to sell something to somebody. At DeCamilla Capital we think it is impossible to consistently avoid market volatility through security diversification, sector rotation, or market timing. We recognize that the 24-hour news cycle and global economic interdependency can create periods of high financial anxiety where there is really no place to hide other than cash.

Random Volatility

DeCamilla Capital utilizes an investment policy and process that expects, recognizes, and embraces random volatility as a permanent characteristic of today’s markets. When fear of market volatility enters into a long-term investment plan it can itself result in portfolio underperformance; and, fearing short-term market volatility can cause investors to over diversify, allocate too much capital to low yielding assets (e.g., annuities), hold high levels of cash, or sell out at market lows. This reaction to the volatility causes a problem that is worse than the volatility itself

We operate under the premise the world will only end once despite daily news headlines. Building investment portfolios for Armageddon is pure folly and against long-term probabilities.

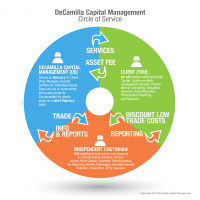

Circle of Service

Click on Thumbnail Below to View Circle of Service

Our Fiduciary Relationship

Fiduciary-Based Investment Management

A fiduciary is a “person bound to act for another’s benefit” and to whom “property or power is entrusted for the benefit of another.”

DeCamilla Capital follows a strict fiduciary standard based upon four pillars: sharing knowledge, building trust and confidence, and serving in a dutiful manner. We operate as investment fiduciaries—managing the assets of our clients for their exclusive benefit.

As money-managing fiduciaries our client relationships are created by express agreement of the customer and DeCamilla Capital. Our overall role is to provide sound investment advice to our clients. We declare our Fiduciary Oath commitment to adhere to a fiduciary ethic and to be accountable for the advice to our clients.

Knowledge

DeCamilla Capital is a discretionary, data driven money management firm. We work in the context of a client’s circumstances for the client’s benefit. We base our investment advice on facts, truths, and principles. Our understanding of stock trends and seasoned companies incorporates current events, economic directions, and global issues. We are subject matter experts but always learning. We communicate with clients in plain language.

Trust and Confidence

The foundation of DeCamilla Capital client relationships is mutual respect and direct two-way communication. We use informed decision-making in our value-driven approach to investing. We gain a client’s perspective through empathy, insight, and listening. Our 30 plus years of one-to-one investment management experience enables our discerning know-how for the client’s benefit.

Duty

As investment fiduciaries DeCamilla Capital is morally and legally obligated to serve the client’s best interests. We have no products to sell. We provide clients with direct account access and investment transparency. We seek to deliver preservation of capital in real terms at the lowest levels of fundamental risk.

Investment Process

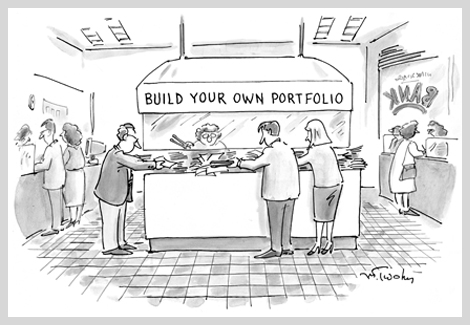

When you become a client of DeCamilla Capital, we customize an investment portfolio for you, tailored specifically to your goals and objectives, and financial circumstances. We take great care in listening to your needs and desires.

We encourage questions and strive to provide clear, factually-accurate answers. Our investment process guide, Building a Customized Portfolio, provides more insight into our approach to executing a business-driven investment portfolio. We encourage you to review it and talk to us about your questions and concerns.

Click on Thumbnail Below to View Flip Book Version

Types of Investment

Accounts

not receive or issue checks and do not custody client securities or assets. All such requests are fulfilled by an independent custodian.

We conduct separate account management. The types of investment accounts we manage include:

- Individual/Joint Tenants

- Trust

- Pension (ERISA- Employee Retirement Income Security Act)

- 401(k) (Deferred Compensation Plans)

- Retirement (e.g., Rollover IRAs, SEP IRAs, Roth IRAs, Traditional IRAs)

- Business (e.g., Sole Proprietorships, Partnerships, Non-profit Organizations, Corporations)

- Custodial (e.g., Guardianships, Trustees)

We do not manage or otherwise engage in:

- Options Accounts

- Day-Trading

- Initial Public Offerings (IPOs)

- Derivatives

- Short Sales

- Insurance Products/Annuities

- Uniform Gifts to Minors Act (UGMA)/Uniform Transfers to Minors Act (UTMA)

- Alternative Investments

We work only with established independent custodians. Prospective clients can maintain their existing relationship with their current custodian. DeCamilla Capital uses Schwab Advisor Services as its primary custodian (we have no preferred relationship with, and do not receive any compensatory remuneration from Schwab).

In fulfilling our fiduciary duties we operate with general discretion and the approval of our clients. We are compensated only through account management fees and receive no commissions to sell or recommend financial products issued by third parties.